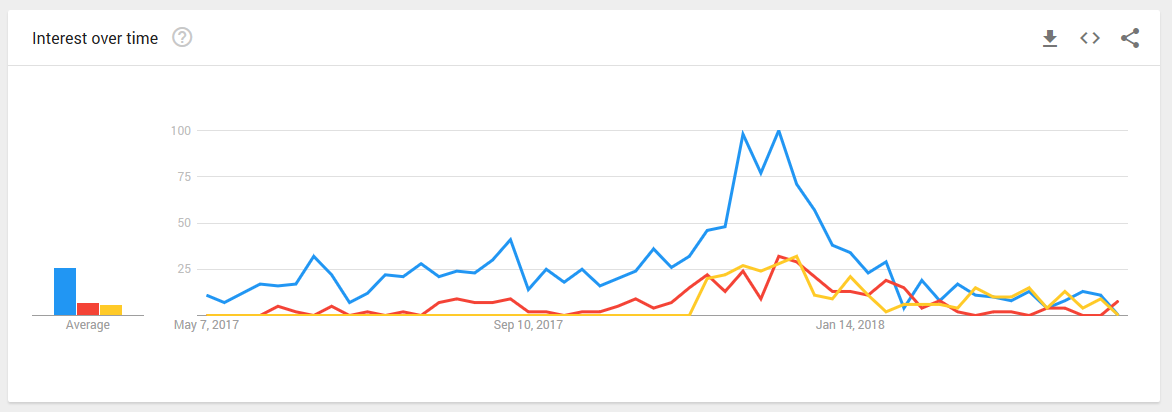

The price of cryptocurrencies varies almost day-to-day and, at times, drastic changes can occur hourly. This makes it an extremely volatile type of currency. Some reports state that a few investors have gained a lifetime’s worth of profits in less than one year. One reason that can explain these substantial variations is that the way cryptocurrencies are traded is quite different from the way other currencies are usually traded. Instead of being situated in one centralized location, cryptocurrencies can be acquired and sold at many different exchange hubs causing maximum volatility. Unlike money, such as the U.S. dollar, Bitcoin and other forms of cryptocurrencies have no fundamental backing from a central bank or government institution.

In fact, no single entity or government institution can claim ownership or control over Bitcoin. This means that only the parties who exchange the currency have control over it. Moreover, unlike money and other forms of currency which can be associated with tangible factors that define its valuation, the price of cryptocurrencies is not determined by the aforementioned physical elements. Typically, an investor would estimate the worth of a stock by looking at a variety of factors including the history its earnings, the economic state and performance of involved countries and so on. However, with no fundamental ties to these factors, the traditional process of currency valuation does not apply to cryptocurrencies hence making it very volatile and difficult to pin down.

According to Forbes, trading with cryptocurrencies requires some shared regulations about the determined value of digital currency much like the manner in which other familiar forms of currency work. However, a clear distinction here is that these rules are determined only by the parties involved in the exchange (the payer and the payee). These parties have full control of the transaction and can decide the terms, conditions and rules of exchange which are then codified. Despite its volatile nature and relative newness, this system of digital transactions has become so popular that it has been adopted in other transaction scenarios such as the signing of contracts, and other implementations such as services, assets and expertise. Some see this as an improvement on other familiar forms of transactions that involve physical forms of money. With cryptocurrency, digital transactions transcend the limits set by human distance, speed and other obstacles of the analog world.

A recent report from Bitcoin Exchange Guide exemplifies the radical nature of cryptocurrencies which often leads to countless shifts in value. The report states that in 2018 alone, the market capitalization of cryptocurrencies increased by more than 3000%. However, the most popular form of cryptocurrency (Bitcoin) also went through four radical price shifts that amounted to a 20% decline in its value within the same period.

CryptoCurrency Facts 2018

CryptoCurrency Facts 2018